19+ income vs mortgage

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Mortgage protection insurance and income protection policies provide a financial safety net in worst-case scenarios.

How Much Of My Income Should Go Towards A Mortgage Payment

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

. Ad Tired of Renting. Mortgages are used by prospective buyers to fund the purchase of a. Dont Settle Save By Choosing The Lowest Rate.

Compare Lenders And Find Out Which One Suits You Best. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Base pay salary or hourly Bonus and overtime Commission Secondary.

Note both loans aim for a 36 DTI which is typical for a conventional mortgage. Ad Compare Best Mortgage Lenders 2023. In that case NerdWallet recommends an annual pretax income of at least 184656.

How much house you can afford is also dependent on the interest rate. Forbearance is when your mortgage servicer or lender allows you to pause or. Web The majority of homeowners are eligible for forbearance for a coronavirus-related financial hardship.

Web Usually non-taxable income is worth 25 more for mortgage qualifying. Web Typically lenders cap the mortgage at 28 percent of your monthly income. Save Real Money Today.

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Looking For a House Loan. Ad Conforming Loans vs Non-Conforming Loans - Contact us today to for more information. They call this practice.

Lock Rates For 90 Days While You Research. Why Rent When You Could Own. Web Mortgages and home equity loans are both forms of borrowing that use your home as collateral.

Compare Lenders And Find Out Which One Suits You Best. Web This drastically affects how much they can borrow for a mortgage. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments.

Web Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances. Web When it comes to calculating affordability your income debts and down payment are primary factors. Comparisons Trusted by 55000000.

But which is better. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Comparisons Trusted by 55000000.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Fannie Mae guidelines allow the following types of income to qualify for a mortgage. With a Low Down Payment Option You Could Buy Your Own Home.

Our full-service mortgage company proudly offers lower interest rates closing costs. Web If youd put 10 down on a 555555 home your mortgage would be about 500000. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web Calculate Your Mortgage Qualification Based on Income In this calculator you can inclue investments annuities alimony government benefit payments in the other income. Ad 5 Best House Loan Lenders Compared Reviewed. With a Low Down Payment Option You Could Buy Your Own Home.

So 1000 a month in child support counts as 1250 a month. Apply Online Get Pre-Approved Today. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

Looking For a House Loan. Were not including any expenses in estimating the. Ad 5 Best House Loan Lenders Compared Reviewed.

Web 12 hours agoIf you are 65 or older or at least partially blind the amount increases by an extra 1400 for 2022 and by 1500 for 2023 or 1750 in 2022 and 1850 in 2023 for. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

25 Million In Rent And Mortgage Assistance Up For Grabs In Sc Wltx Com

Golocalprov 32 Of Americans Missed Making Full Rent Or Mortgage Payment In July

Home

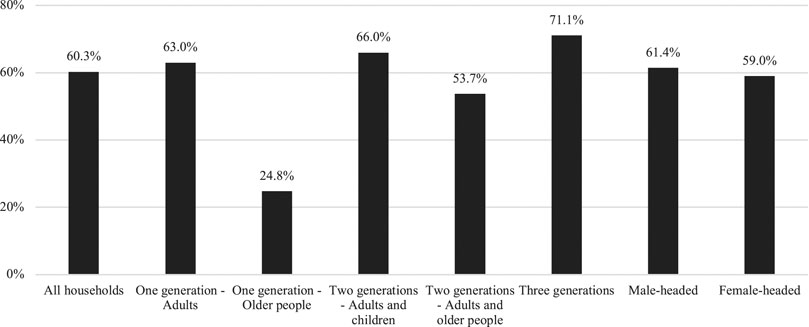

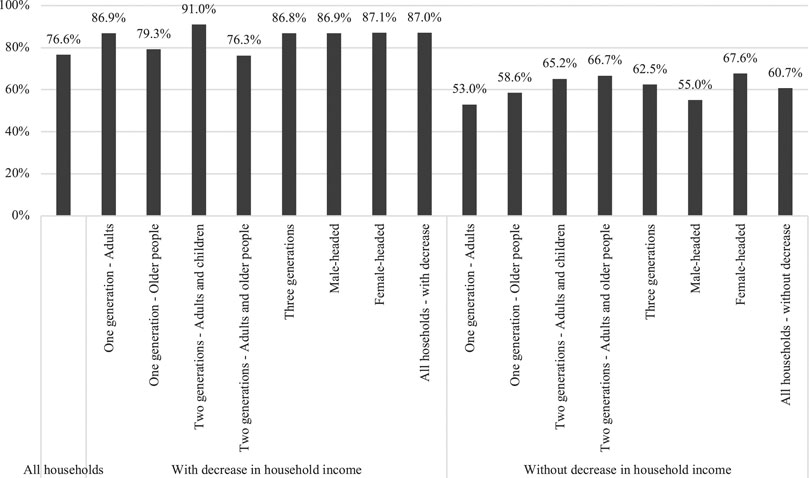

Frontiers Household Coping Strategies During The Covid 19 Pandemic In Chile

Advanced Learner Loan Ghq Training

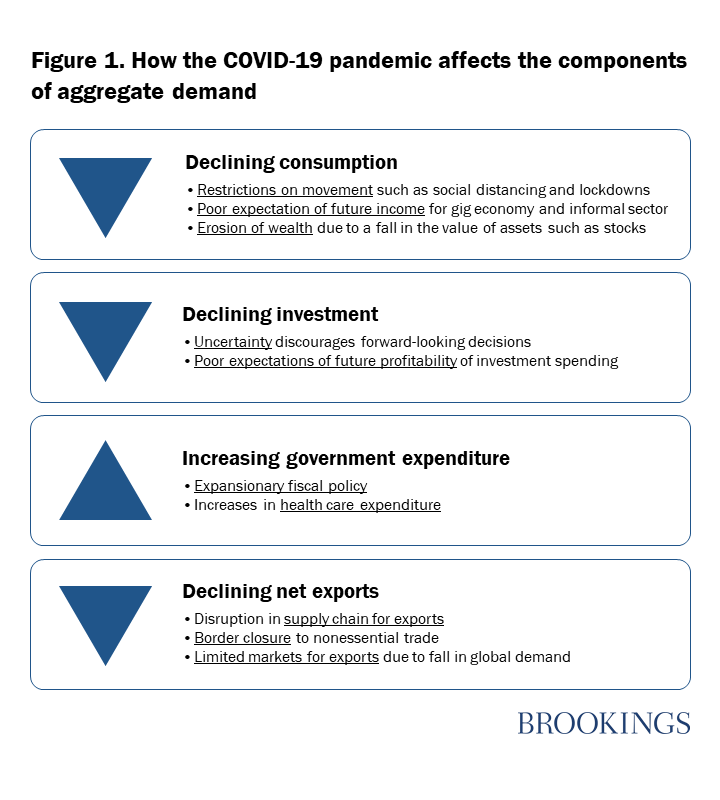

Understanding The Impact Of The Covid 19 Outbreak On The Nigerian Economy

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

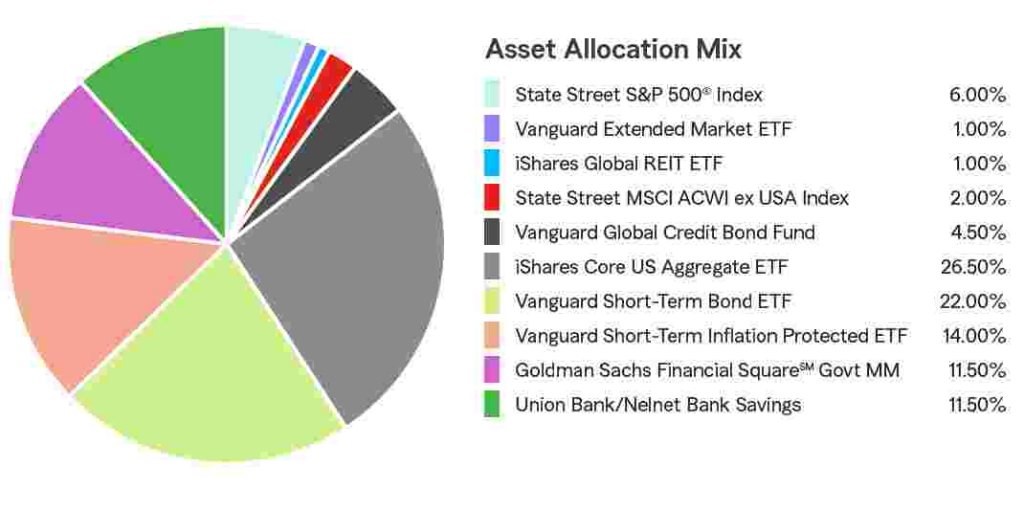

How To Choose 529 Plans For Your Child S Education Moneygeek Com

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

Southpoint Sun October 19 2022 By Southpoint Sun Issuu

Frontiers Household Coping Strategies During The Covid 19 Pandemic In Chile

Leo Gocemen Vice President Of Mortgage Lending Crosscountry Mortgage Cleveland Linkedin

Nutrients Free Full Text The Impact Of The Covid 19 Pandemic On The Food Security Of Uk Adults Aged 20 Ndash 65 Years Covid 19 Food Security And Dietary Assessment Study

How Much Of My Income Should Go Towards A Mortgage Payment

Michael Crofton Bornface Mukundu Mortgage Choice

How To Finally Pay Off Your Mortgage Wltx Com

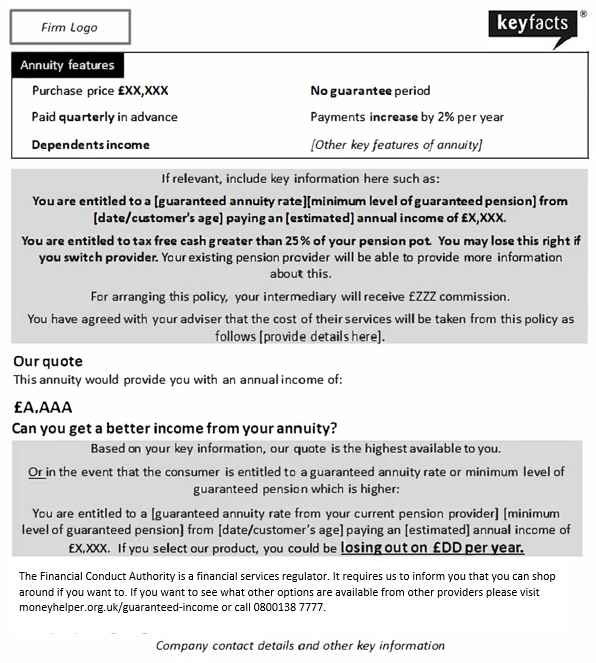

Cobs 19 Fca Handbook