Business loan borrowing capacity

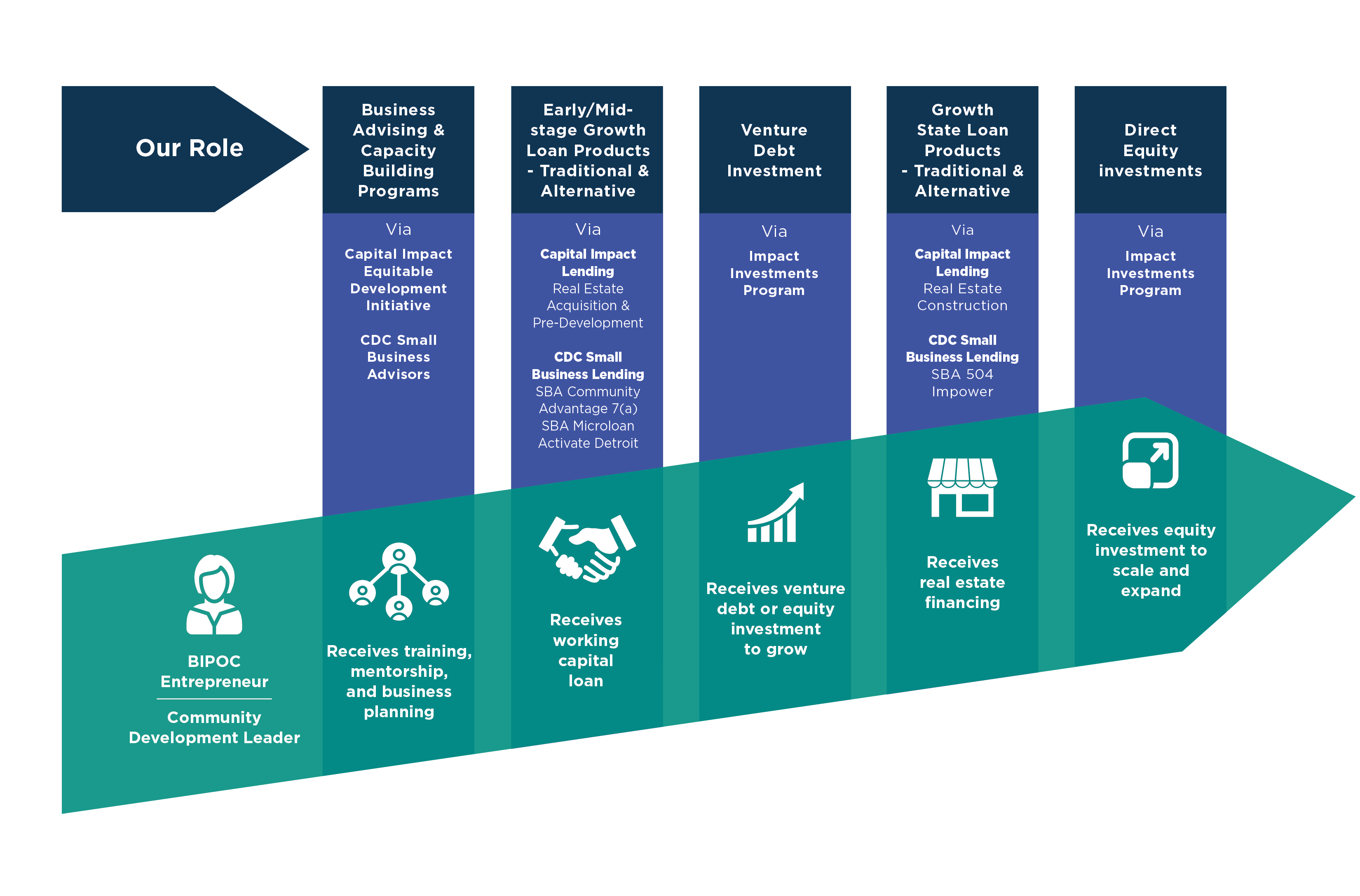

Find the right lender. A companys borrowing capacity depends not only on its ability to handle the monthly payment but a number of other factors.

Business Loan Process Propel Finance

Business Marathon Doubles Loan Borrowing Capacity to 200M as Mining Rigs Sit Idle The firm doubled its credit from Silvergate Bank even as Marathons operations are facing.

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

. The borrowing power calculator allows you to determine how much you can afford to borrow in a loan based on the income and expenses. We take pride in spending the time to deeply understand our clients. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today.

The lender you choose allows a 50 advance rate for the inventory and 70 advance rate for the accounts receivable as the borrowing base. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Borrowing Capacity Calculator Please enter the information requested in the form to calculate the monthly repayments on your Loan.

Debt capacity refers to the amount that a company can reasonably borrow and pay back within a specified time period. A customized debt capacity can help a company test the. Here are seven tips to help you borrow effectively for your small business and that will boost your chances of getting approved.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Buying or launching a new business. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Based on that our Business Loan calculator shows that you. You would like to repay the loan over a 12 month period and youre comfortable with a 15 annual interest rate. The capacity of a business is the ability to pay back a loan.

Online Borrowing Power Calculator For Australia. Why to borrow. The ratio of business debt to gross domestic product declined in the second half of 2020.

A lender will look at your debt-to-income DTI ratio to calculate capacity. A business takes on debt for several reasons. Product Type Loan Term Years Interest Rate pa Your.

Compare home buying options today. The formula to calculate your. Starting a new business Funding working capital Buying land or a.

Some common reasons to consider a loan for your business include. Lenders look at several financial metrics before deciding how much. View your borrowing capacity and estimated home loan repayments.

Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of a debt agreement. The maximum loan amount for a 7 a loan is 5 million and the funds may be used for almost any business need including. Lenders will compile your sources of income deduct.

Expanding an existing business. Interested in knowing how our funding solutions solve your business cash flow needs. A number of factors determine the amount of money that a business can borrow.

Business debt increased little in the second half of 2020 while nominal GDP grew 10 percent. There are certain criteria. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Borrowing capacity is the amount of money a bank or financial institution will extend to you based on your current financial position. In this scenario your business. Credit history employment history.

The Fed Availability Of Credit To Small Businesses September 2017

The 5 C S Of Credit What Lenders Look For

Working Capital Loans For Small Businesses Funding Circle

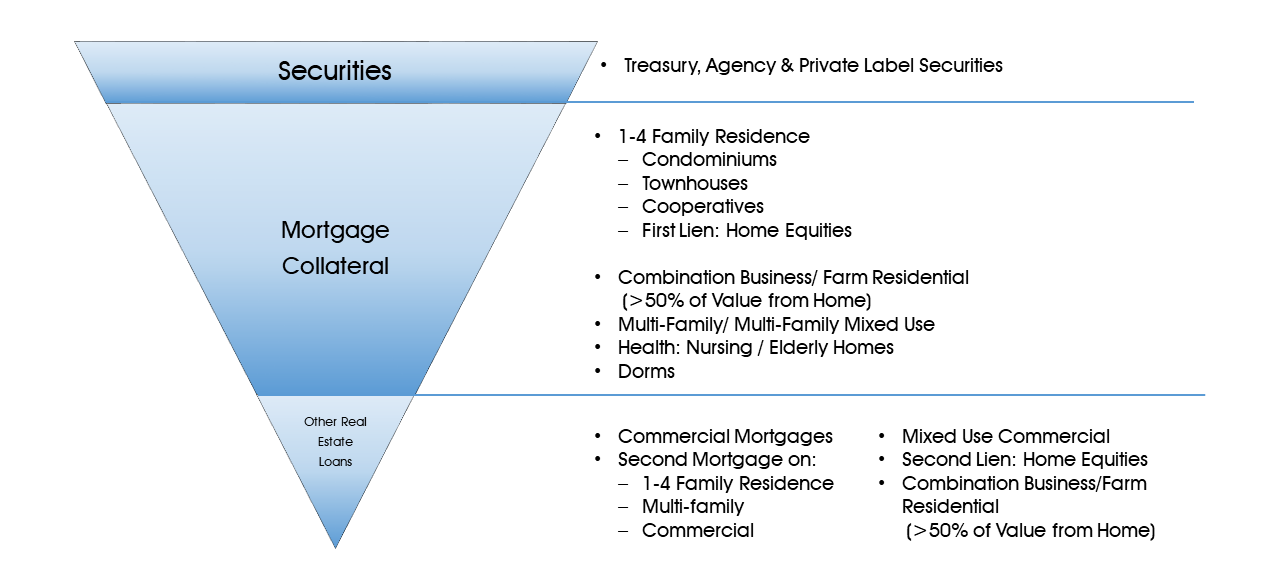

Collateral Guide Federal Home Loan Bank Of New York

How To Negotiate A Term Loan

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Commercial Bank What You Need To Know About Commercial Banks

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Small Business Terms Loans A Comprehensive Guide Funding Circle

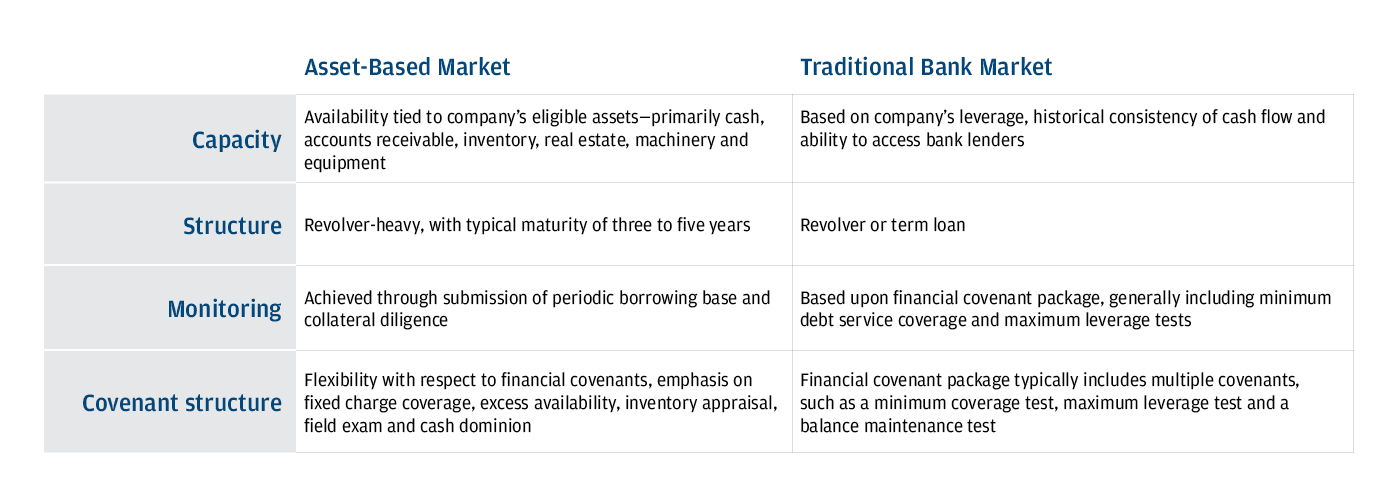

What Is Asset Based Lending Who Qualifies

Sba 504 Commercial Real Estate Loans Explained In 5 Minutes

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Sba 504 Commercial Real Estate Loans Explained In 5 Minutes

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

Lvr Borrowing Capacity Calculator Interest Co Nz

Best Startup Loans Of September 2022 0 Apr Available Finder

Free Business Loan Agreement Template Legal Templates